In today’s world, many of us rely on digital payments to make purchases, whether online or in a physical store. With the rise of contactless payments, Near Field Communication (NFC) technology has become increasingly popular. NFC payments offer a safer and more convenient alternative to traditional payment methods such as credit cards and cash. In this article, we’ll discuss why NFC payments are more secure than traditional payment methods and how this technology is changing the way we pay for goods and services. So, whether you’re a tech lover or just curious about the latest trends in payment technology, read on to learn more about NFC payments and why they’re the future of secure digital transactions.

Introduction to NFC payments

Before we dive into the details of NFC payments, it's important to understand what they are and how they work. NFC technology enables wireless communication between nearby devices over short-range radio waves. This means that two NFC-equipped devices can exchange information simply by placing them next to each other. NFC payments are one way to use this technology to make financial transactions.

What are the traditional payment methods?

Before exploring why NFC payments are more secure, it's helpful to understand traditional payment methods and how they work. Traditional payment methods include cash, checks, credit and debit cards, and bank transfers. Each of these payment methods has different levels of security, convenience, and processing time.

Why are traditional payment methods vulnerable to fraud?

Although traditional payment methods have been used for decades, they are still vulnerable to fraud. Cash can be stolen or counterfeited, checks can be altered or rejected, and credit and debit cards can be cloned or stolen. In addition, traditional payment methods often require sharing personal information, such as bank account number or PIN code, which increases the risk of identity theft and fraud.

How do NFC payments work?

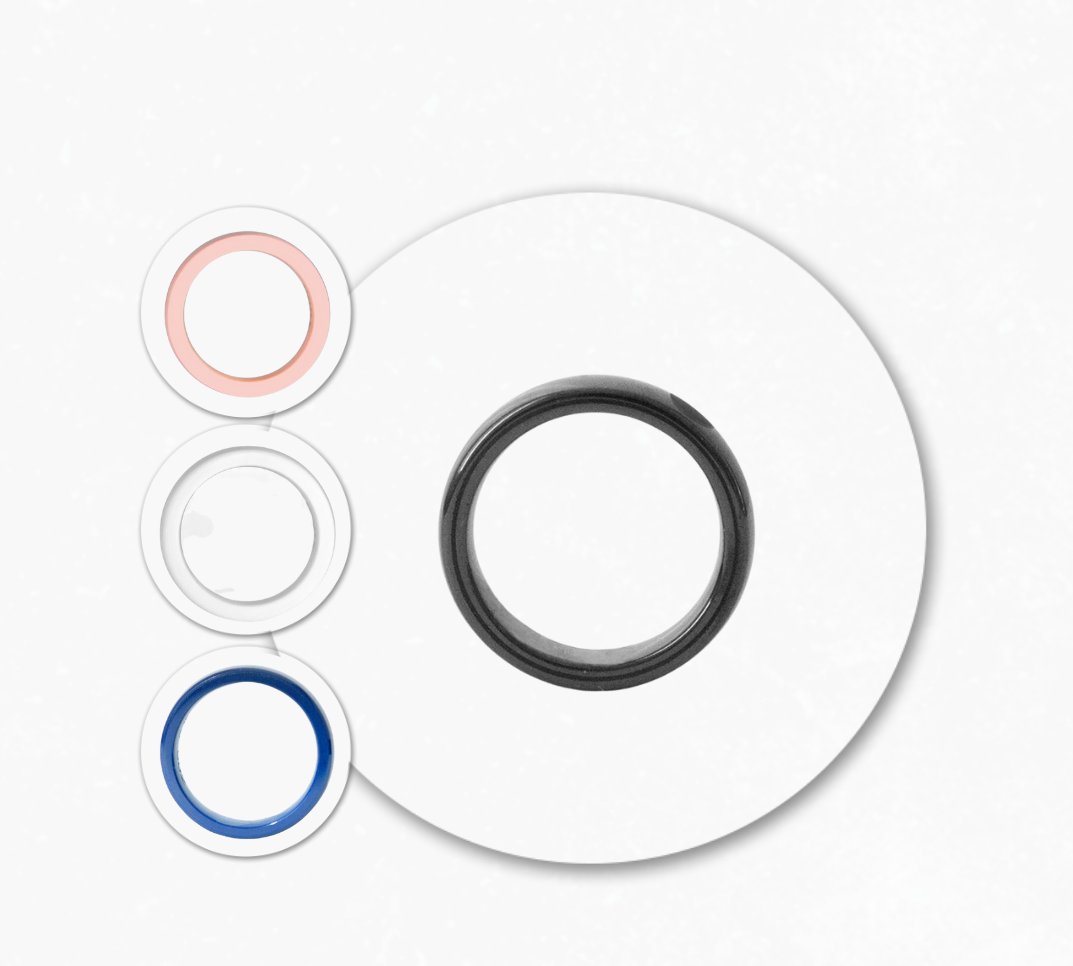

NFC payments work in a similar way to credit and debit cards, but without the need to insert or swipe a physical card. Instead, an NFC-enabled device, such as a smartphone or Rikki payment ring, is used. To make an NFC payment, the device is placed near the NFC-enabled payment terminal. Transaction data is transmitted wirelessly over short-range radio waves and processed in a secure, encrypted manner.

Security features of NFC payments

NFC payments have several security features that make them more secure than traditional payment methods. Firstly, NFC payments use encryption technology to protect transaction information. Secondly, to make an NFC payment via a payment ring or bracelet, the card number and the name of the cardholder are never displayed – both key data for fraudulent cloning of a bank card. In addition, NFC payments use tokenization technology, which means that a unique token is created for each transaction that cannot be used for other transactions.

Examples of companies using NFC payments

NFC payments are becoming increasingly popular around the world, and many businesses are already using this technology. Some examples of companies that offer NFC payments include Apple Pay, Samsung Pay, Google Wallet, Visa payWave, Mastercard PayPass, and Rikki Pay Rings. These services allow users to make NFC payments using an NFC-enabled device, such as a smartphone or a payment ring.

Comparing NFC payments with other payment methods

Compared to other payment methods, NFC payments offer several important advantages. First, NFC payments are faster and more convenient than traditional payment methods, as there is no need to insert a physical card or enter a PIN code. Second, NFC payments are more secure than traditional payment methods, as they use encryption and authentication technology to protect transaction information. Furthermore, NFC payments are more flexible, as they can be made from anywhere with an Internet connection and an NFC-compatible device.

Future of NFC payments

NFC payments are an ever-evolving technology, and are expected to continue to evolve in the future. NFC payments are expected to be increasingly integrated into consumer devices such as payment rings, smart watches, and virtual reality devices. In addition, NFC payments are expected to be increasingly used in business environments such as the hospitality industry and event management.

Conclusion

In conclusion, NFC payments offer a more secure and convenient alternative to traditional payment methods. NFC payments use encryption and authentication technology to protect transaction information and are faster and more flexible than traditional payment methods. Furthermore, NFC payments are becoming increasingly popular around the world and are expected to continue to evolve in the future. For all these reasons, NFC payments are likely to remain an important part of how we pay for goods and services in the future.

Rikki's team

1 comment

Estoy interesado

Soy de Chile

Espero su respuesta quisiera comprar un anillo y probarlo acá en mi país