Vacation on the horizon. How to pay and avoid being robbed?

Share

The season of free will and "dolce far niente" is here. Even if it's only a few days, how can you give up the prospect of a getaway to a foreign land? Planning a trip is always exciting, but it also raises important questions worth considering. One of them is how to manage money to cover your bills during the trip. What's safer, cash or a card? What's more practical: exchanging cash for the local currency, and in this case, how much? Or should you rely on your card and cross your fingers that it doesn't cause problems? And if the solution is a mixed one, how do you balance it?

Naturally, the answers to these questions depend on your payment habits and the country you're traveling to, so this article addresses the considerations you should keep in mind when choosing to use a bank card.

The first is the destination country, because that's where the questions arise: currency exchange fees, payment methods offered by data phones, merchants' tricks, regulatory framework in case of being a victim of fraud, etc.

Currency exchange fees: Which bank should you travel with and what currency should you pay in?

The commission for currency exchange depends primarily on the agents involved in the exchange: on the one hand, the card network (Visa or Mastercard) applies its own conversion rate, which is updated daily, and on the other, the card-issuing bank adds its own exchange rate, which can vary between 0.5% and 5%.

As you can see, if you intend to use a card to pay, before leaving on your trip it's a good idea to find out which bank to use, as the difference at the end of your trip can be significant. In many cases, using a card is more cost-effective than exchanging cash into local currency, especially because you'll be able to find an exchange office when you need it, where the current exchange rate is applied without additional fees. Withdrawing money from ATMs is also an expensive option, and you have to be very careful not to use "doctored" ATMs that have devices installed that steal card data.

Finally, when paying by card, the card reader may also offer the option to pay in your home currency (euro) or in the local currency. The difference can be significant, given that if you pay in euros, the merchant's bank converts the money to the local currency, and if you pay in local currency, your bank handles the exchange rate. If you've chosen your bank wisely, it makes sense to ask to pay in your local currency and benefit from a good exchange rate. If you choose to pay in euros, the merchant's bank applies the exchange rate, and you have no information or control over this. Therefore, it's best to choose to pay in your local currency.

Card payments abroad: what risks do they entail?

The biggest risk of using a bank card to pay while traveling is cloning it. It's a very subtle way to steal your credentials without you even realizing it, and can leave your account at zero or, worse yet, in the red if it's a credit card. To clone the card, simply take photos of both sides to copy the details: PAN (National Account Number), cardholder, expiration date, and CVV (CVV). This is sufficient to process payments in countries where legislation allows this without securely identifying the customer.

And here's the important part: when paying by card, the laws in force in the country where the local merchant operates apply, so you're subject to rules that are generally unknown. For example, in the US, the policy for processing payments without a PIN or signature depends on what the merchant's bank defines. Or, without going any further, in Europe, the requirement to request a PIN varies by country (in Spain for amounts starting at €50 and in France for amounts starting at €100). The point is that, according to a report issued by the European Banking Authority (EBA) in 2024, 71% of the amounts defrauded during the first quarter of 2023 corresponded to cross-border transactions.

There are various methods for cloning cards , but they're mainly based on tactics designed to make us lose control of the card for just a few moments. For example, in Spain, it's relatively common to hand the card to the receptionist to pay for a room reservation, or to the waiter to pay for drinks. In other countries, this practice is a sure thing that will ruin the rest of the trip and leave a bitter memory of the vacation. Therefore, always and without exception, when paying, you must ask for the card reader so we can process the payment ourselves.

Another less common cloning method , but widespread in many countries, is hacking the card reader or ATM. With this practice, the cybercriminal can not only record the card data recorded on the magnetic strip or EMV chip, but can also capture the authorization PIN using a hidden camera or a manipulated keypad. Consequently, whenever possible, it is much safer to use the contactless method for both paying and withdrawing money from ATMs.

Now, wherever contactless payments are accepted, mobile payment is an option, undoubtedly a safer alternative to plastic cards. To clarify, a smartphone is a hot wallet that tokenizes cards and uses biometrics to authorize payments. Tokenizing a card means replacing its data with numbers that, by themselves, cannot be used to process payments and that only Visa or MasterCard can identify to complete the transaction.

In any case, as has been mentioned before, the hot wallet, because it's constantly connected to the internet, is exposed to a large number of cyberattacks. Furthermore, mobile phones are coveted by all kinds of criminals due to their value and high concentration of sensitive data. And being without a phone during the holidays isn't exactly the best of scenarios.

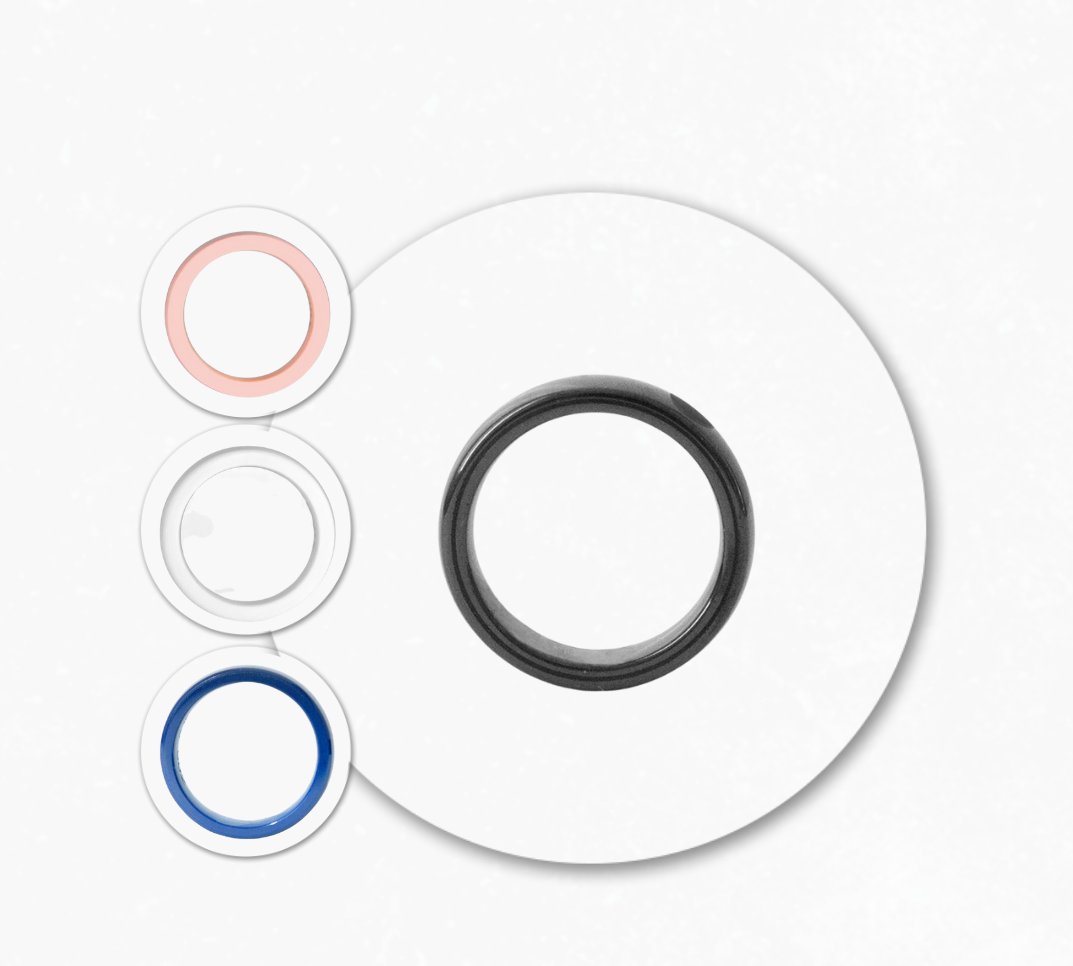

The safest payment option, especially when traveling, is based on contactless payment through a cold wallet that stores a tokenized card. These devices store the bank card token in their NFC chip in cold storage , or, in other words, disconnected from the network, greatly reducing the risk of cyberattacks and data theft. A good example of this type of device is the Rikki smart payment ring. Being a device exclusively dedicated to payments , it is discreet, requires no battery, is always with us, is difficult to lose and even more difficult to steal, and prevents the accumulation of other valuable data. With this ring, you can pay very securely with a simple hand gesture, without having to search through your wallet or purse. And, for those afraid of being robbed, of course they can, but it is much more difficult than stealing a wallet or cell phone. Just like with the card or cell phone, the ring can be remotely disconnected to block payments.

In conclusion, the bank card is undoubtedly a good travel companion as long as the necessary measures are taken: control the exchange rate, do not share it with a third party, even for a moment, and pay whenever possible using the contactless option and with tokenized cards, either by mobile phone or, better yet, through a cold wallet like the Rikki payment ring.