Rikki, the smart ring that lets you pay just like a bank card

Share

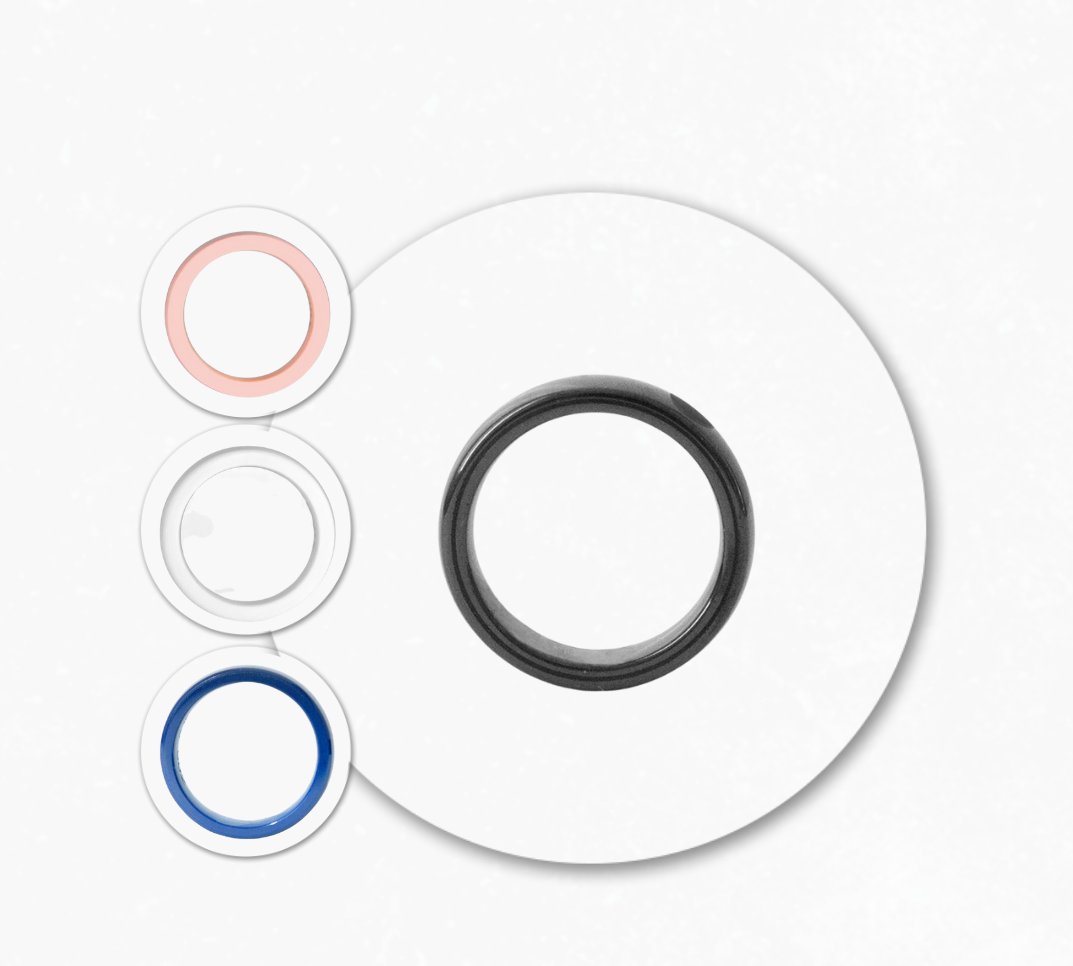

With a design inspired by Japanese minimalism, Rikki's payment rings mark the latest technological innovation in financial wearables. After its launch in the Spanish market at the end of November, this innovative payment method presents a truly comfortable, autonomous and waterproof format for the user in their daily life.

Rikki rings, which come in a sophisticated black colour, offer a secure payment experience backed by MasterCard, so the user can pay at any store in the world that accepts contactless payments.

The key to its operation is its autonomy, as it does not need to be connected to the internet or a smartphone to validate the operation. To make a payment, you simply need to move your finger to the POS terminal. Quick and hassle-free, it is an alternative for those who long for the freedom of leaving their card and cash at home .

The use of the rings is synchronized with the user app, which, depending on the plan chosen, allows the user to add several cards owned by the user and select where to charge the ring's expense, change the expense from one card to another, such as from personal to business, or choose the "no shame" mode so that a payment made with the ring is never rejected.

Parents of minor children can also create a Junior card and associate it with a ring so that their children can learn to manage their finances more easily. Elena Yorda, CEO of the brand, explains the origins and distinctive features of the Rikki rings.

How did the idea for Rikki's rings come about?

The banking sector has traditionally been traditional and not very prone to innovation. I remember years ago, when I was at IESE, hearing senior executives in Spanish banking say that the banking business is the most boring in the world, that as a low-margin business, the only thing you had to look after was the profit account.

And it was not surprising that fintechs burst into this void and changed the banking industry: 100% online registration, full operations from mobile, commission-free accounts, low-cost currency exchange, and much more.

Then ApplePay, GPay, etc. came along and allowed us to improve the payment experience, replacing cards with mobile phones. But mobile phones are a bit like TV: at first they seem like the ultimate, but little by little they start to get tiring: the intrusion, having to worry about recharging, the mental noise they generate… What I needed was a “silent” payment method, always available, discreet. Something that didn’t make you search through your bag, or force you to open your wallet and show off multiple cards. Something nice, convenient and very discreet. That’s how Rikki came up with the idea.

Why was it decided to materialize this idea in the form of a ring?

The truth is that we had started to develop the idea in the form of a bracelet and it is something that we still believe has its market. But the ring was more comfortable for us, especially when making the payment. You always wear it, the gesture of bringing it close to the dataphone is very natural and it is very difficult for it to be stolen or for an “accidental” charge to be made.

What advantages do they bring to the user?

It's discreet, minimalist, waterproof and very stylish. Imagine summer on the beach, coming out of the sea and going straight to the beach bar to have a drink in just your swimsuit.

Jokes aside, the ring offers you a lot of convenience and the highest banking security. It is certified by both MasterCard and Visa and has a PIN code for higher purchases.

Thus, Rikki establishes itself as a proposal to revolutionize payment methods with an innovative, convenient and versatile idea.

1 comment

Hola mi pregunta es la siguiente en pagos de de mas de 50€ como hay que poner pin , esa es mi duda , gracias