The card's magnetic strip or Masiel's La La La

Share

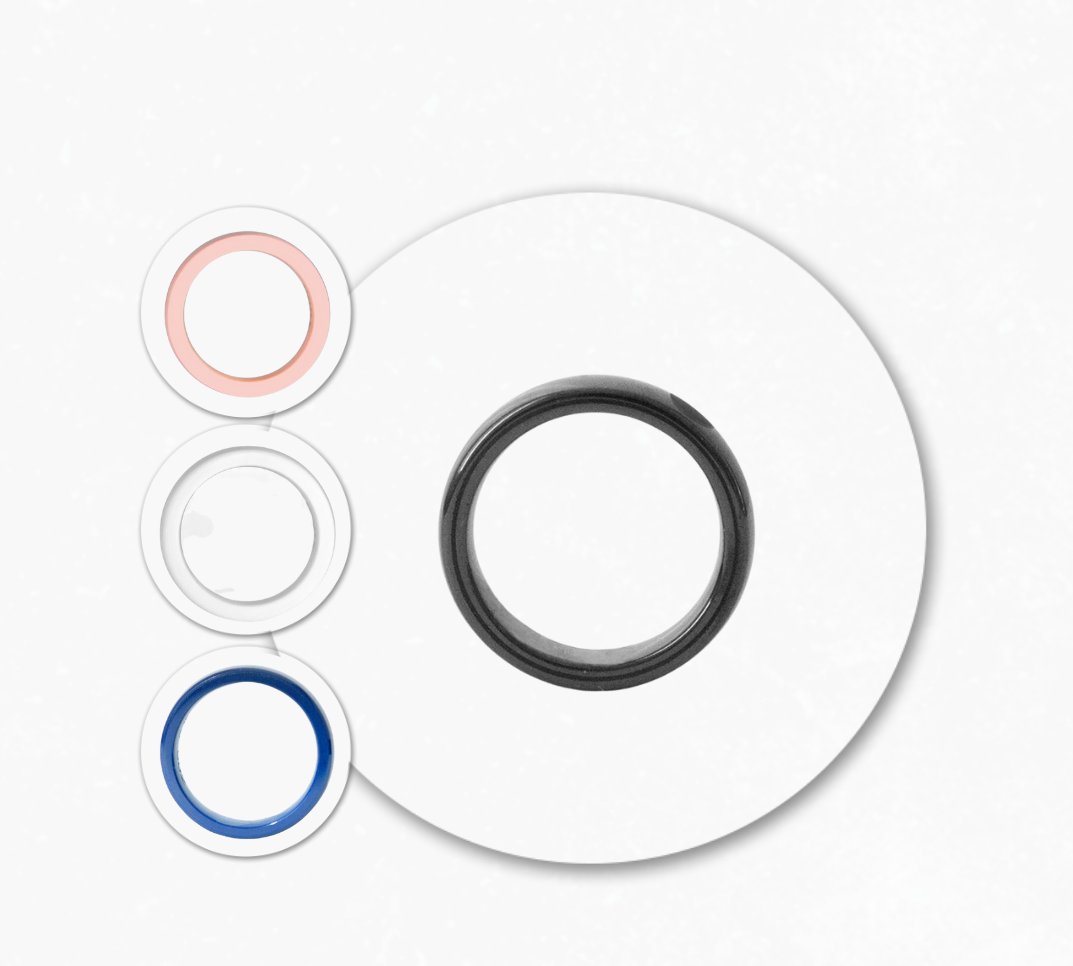

Image: Civil Guard (@guardiacivil)

The card's magnetic strip stores the data in static form, meaning this data is written almost as clearly as the lyrics to Massiel's "La La La." Well, when the first cards came out, cybercriminals designed devices that, camouflaged in data terminals and ATMs, are capable of intercepting them at the moment the payment is processed or the ATM is used. BAM! That's when they clone our card without us realizing it, but, to make matters worse, there was a camouflaged microcamera on the ATM focusing on the keypad that captured the PIN, or the keypad itself was manipulated to record it.

This method of data theft was so widespread in America that it caused huge losses, migrated to Europe, and forced the adoption of new card security measures. Although it is now fairly controlled in our country, we should not let our guard down. In fact, both the Civil Guard and the National Police continue to warn about it today.

It's also important to keep in mind that even the business itself can be involved in fraud without realizing it, since they can inadvertently replace their card reader with a tampered one.

CONCLUSION: Avoid using the card's magnetic strip to process POS payments or withdraw cash from an ATM, if possible. Otherwise, inspect the terminal from top to bottom for possible theft, especially the insertion slots and keypad. Even if you're alone at the ATM, don't make a fool of yourself by covering the keypad when entering your PIN.

From a retail security perspective, it's important to note that the magnetic stripe is the most commonly used mechanism for recording fraudulently obtained card data. This means that cybercriminals will most likely pay the merchant using the magnetic stripe of a counterfeit card. So much so that many businesses don't accept this payment method even if the card reader allows it.

Although this payment method is unfortunately falling into disuse around the world, some ATMs and credit card machines maintain it because it's an alternative for cards with damaged chips or cards from countries where chip technology has not yet become widespread.

For the same reason, the bank also keeps it on the card as a backup in case the chip is damaged, or for use abroad in stores that only offer this option.